Credit Basics

Your credit score determines if you can get a loan and how much you will pay for a loan. Here are some basics on the factors that go into your credit score and how you can protect your credit.

Know Your Score

Pro tip 1: The free credit report available at AnnualCreditReport.com will show what has been reported to the credit agencies but it will not give you your credit score. We will provide you with your score as a part of a pre-purchase assessment.

Pro tip 2: When two people are applying for a mortgage, the lower score of the two is the one that is used. Don’t think you can let your credit slide because your partner has great credit.

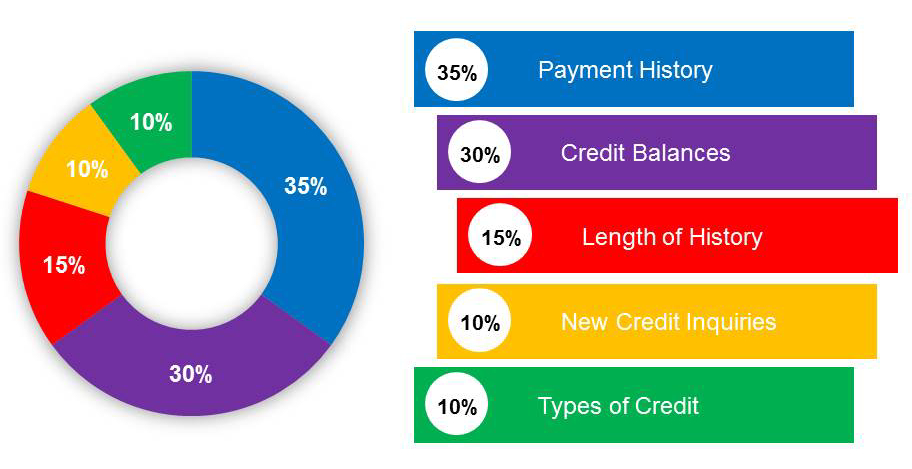

What Determines Your Credit Score

Pro tip 3: Services such as Credit Karma and Mint use their own algorithms and can be off by as much as 100 points. You will need a tri-merge credit report to accurately determine the interest rate for which you will qualify.

How to Improve or Protect Your Credit Score

- Don’t miss payments – Your recent payment history is extremely important

- If you are late, pay as soon as you can – Late payments get reported if they are over 30 days late. Payments of 90 days late are considered a serious delinquency and really impact your score.

- Some payments are more important than others – Late payments on mortgage payments, student loan debt, installment debt and revolving debt will count against you the most. There is some leniency with medical debt.

- Pay down you credit card debt – Having a card balance that is more than 30% of the credit limit hurts your credit score

- Don’t apply for credit you don’t need – Having too much available credit and too many credit lines can hurt your score

- Keep older credit lines – As long as you don’t have too much available credit, old credit lines show stability

- Have at least three lines of credit – having two lines or less is considered to be a “thin”” credit history

- Plan ahead – Building up credit long before you intend to purchase a house is a benefit.

- Don’t apply for new credit lines – Store credit and consumer credit are particularly bad for your score

- Don’t switch cards – If you want to switch cards to get points or lower your interest rate, do it after the purchase of you home has closed.

- A mix of different types of credit helps your score – Having installment debt and revolving debt can help your score

- There is good news – Having a mortgage with a good payment history will help your score in the future.

Pro tip 4: It can be hard to save for a down payment and pay down credit card debt at the same time. Additionally, different borrowers need to do different things. Some borrowers need to save, some need to pay down balances and some need to pay off certain debts to reduce monthly payments. We can guide you in what steps to take so you can purchase a home faster.