Steps in the mortgage process

There are a lot of steps in the mortgage process but it should never be a mystery. I will walk you through each step so you have complete confidence the whole time.

Pre-qualification is a review of your financial situation and a discussion of your future goals. It helps us gather information to match you with the best loan product and helps you identity a realistic price range for your housing search. Documentation of income and assets is not required and a credit check isn’t required although it is often helpful. Pre-qualification is a great place to start your housing search. We can even help you find a Realtor if you are not working with one.

In this step, you will provide the information needed for your loan offer to perform the loan analysis. The initial application can be filled out in person, over the phone or online. You are not actually applying for a loan at this time. You can proceed to the online application here .

This is where the fun begins. We take all of the information gathered in the previous two steps and find the best loan program for your specific situation. At this step, we can discuss interest rates and payment amounts. We can show you why one loan program is better for you than another. You will also receive a fee work sheet which shows the fees associated with your loan.

This is were we document the information you have provided. We review pay stubs, W2s, tax forms, bank statements and assets. Credit must be pulled for a pre-approval. At the end of this process, we will be able to provide you with a pre-approval letter to include with an offer. A pre-approval is a commitment by the lender to lend and greatly increases the chances of having your offer accepted.

It may not seem like your loan officer would have much involvement with your housing search but that isn’t entirely true. Loan programs may or may not be available depending upon the house you chose. The amount of income needed to qualify for different houses in the same price range can vary greatly due to taxes and HOA fees. There are also several loan considerations when making an offer. You will want to be in touch with your loan officer during this part of the process.

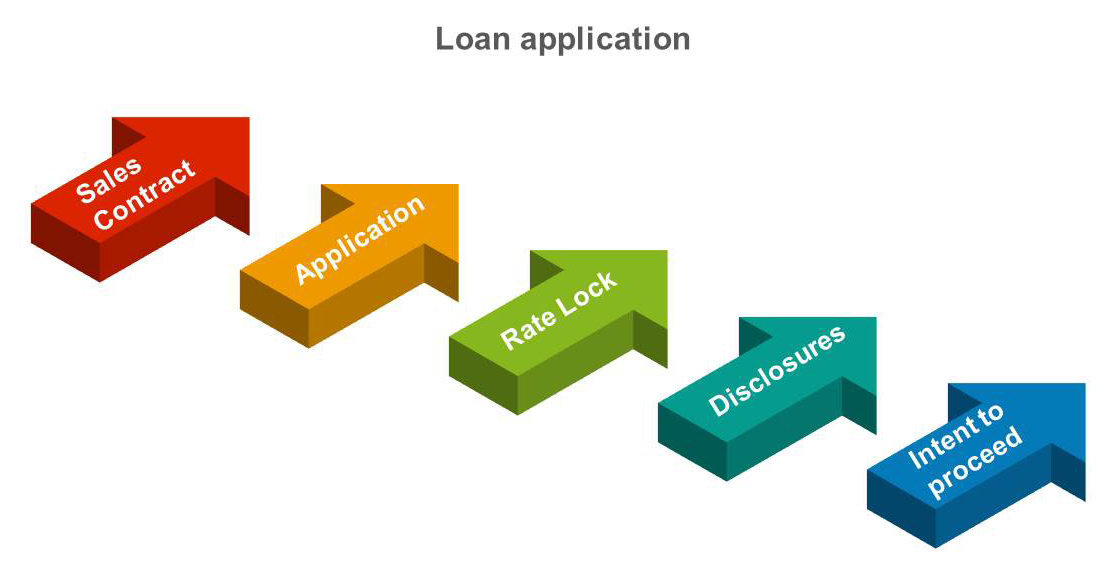

This is an important milestone in the home loan process. You can officially apply for a loan once you have a sales contract.

Now that you have a sales contract, it is time to apply for a loan. Your loan officer will perform another loan analysis to make sure you are getting the best deal possible before choosing a lender for your loan. Once this is complete, you will receive your official loan application.

You will now have the option of locking an interest rate on your loan. This will also lock in your payment amount. You do not have to lock the rate at this time an can let it “float” instead

Along with your loan application, you will receive a packet of federally mandated disclosures. The most import of these disclosures is the loan estimate. This document will spell out all of your loan fees and costs as well giving you an estimate of the funds you will need to provide at closing.

Now that we have your signed application and you have your loan estimate detailing the fees and costs associated with your loan, it is up to you to decide if you would like to move forward with the loan. We can’t move forward with other steps such as ordering an appraisal until you have given us your intent to proceed. This step allows us to charge for the credit report and appraisal. You are not responsible for any other loan costs until your loan closes.

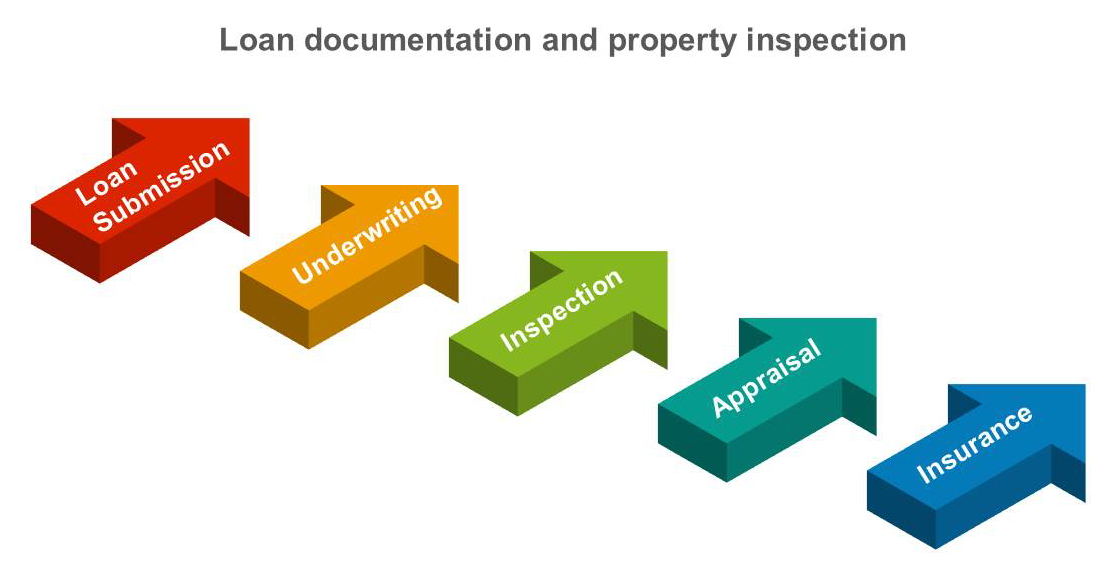

Once we have your intent to proceed, we are hard at work completing your loan file and uploading it to the lender. This means we will likely requesting more documents and providing explanations for any irregularities in your file. It is extremely important to work with your loan officer to complete this step as quickly as possible. The underwriter does not start working on your file until we have submitted a complete file.

The underwriter is the person who makes the decision to approve or decline your loan. To do so, they go through the loan file with a fine toothed comb. Once the file has been approved, the underwriter will attached conditions that need to be met in order for the loan to be funded. This likely means more documentation to “clear” the conditions. It is the loan officer’s job to to make sure there are a few surprises as possible through a thorough evaluation and documentation during the pre-approval and loan submission phases

The home inspection does not directly involve your loan officer. You will schedule and pay for it through your realtor. It will not show up on the loan estimate or closing disclosure. It is an important part of the buying process and ideally we will wait to order your appraisal until the inspection contingency has been removed.

An appraisal is an independent valuation of your home. It protects both you and the lender. In some cases, the home you are purchasing could be eligible for an appraisal waiver.

In most cases, your home owners insurance will be paid out of your escrow account. You will need to chose your insurance coverage before well before your closing date.

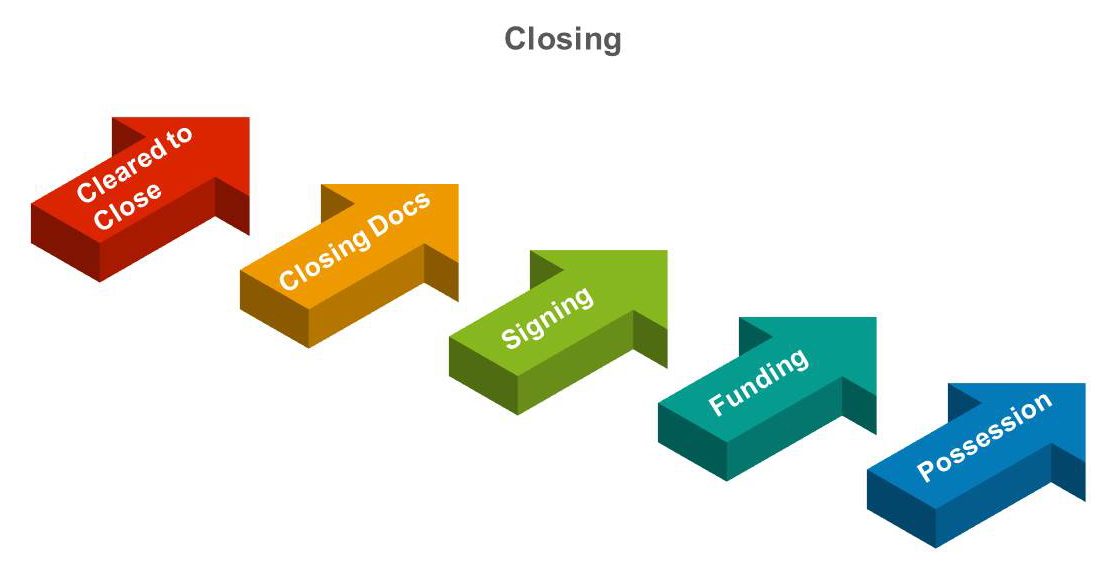

This is a big step for both the loan officer and the home buyer. It means the hard work of loan documentation is nearly over and the conditions from the underwriter have been met.

The next step in the process is the closing docs. Once the underwriting conditions have been met and the actual costs associated with your loan have been rounded up, you will receive a closing disclosure. This document details the final costs associated with your loan. By law, you must receive your closing disclosure three days prior to closing. You will be asked to sign the disclosure and then your closing docs can be sent to the escrow agent. The escrow agent will then schedule your signing.

The signing or closing is where you will sign all of your loan documents. You are not obligated to take out the loan until you complete this step. In most cases, funds are due from the borrower for the down payment and loan costs. You will pay these funds to the escrow agent via bank check or wire transfer at signing.

After signing, the lender will receive the loan documents and they will wire the proceeds of your loan to the escrow agent. The escrow agent will pay off any existing mortgages on the property and distribute the remaining funds to the seller.

This is the last step and it happens after all of the funds have been settled. The escrow company will record the transfer of title with the county. The buyer’s agent and seller’s agent will be notified and arrange for you to pick up the keys. Congratulation, you are now a home owner.