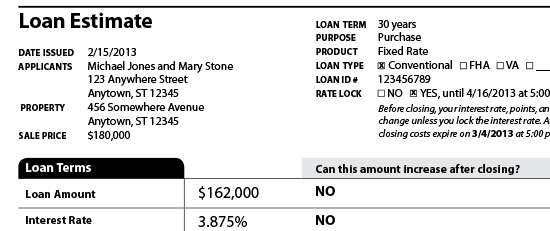

Common Fees

Shopping for a loan can be difficult. We break down all of the fees so you have complete confidence in your decision. This handy guide breaks down the common loan fees.

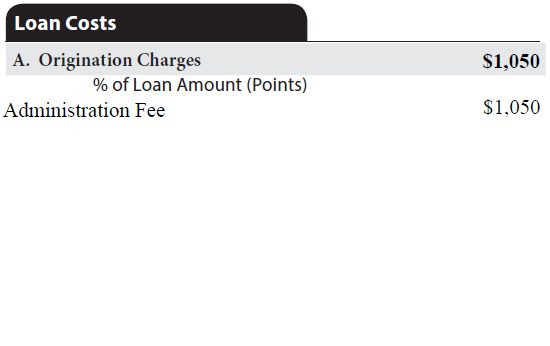

Origination and Discount Points

- These are fees that are charged by the lender to originate your loan

- The fees in this box can have many names and very by lender. They can be called administration fees, origination fees, underwriting fees, processing fees or document preparation fees.

- Some lenders will try to hide the true cost of origination charges by breaking them up into smaller fees. Don’t be confused, they are all origination fees.

- If you are paying discount points to buy down your interest rate, the points will appear in this box.

- Pay close attention to this box when shopping for a loan.

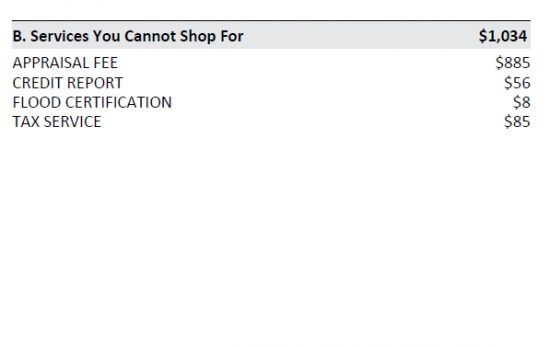

Fees you Cannot Shop For

- These are fees where you are required to use the service provider chosen by the lender.

- You can only be charged for fees that have been uncured. origination The lender does not make a profit on these fees.

- These fees do not vary a great deal between lenders but they can vary between different loan types.

- If you are applying for a loan that has upfront mortgage insurance such as an FHA, VA or USDA loan, the upfront premium will appear in this box.

Fees you Can Shop For

- These are fees that are related to preparing the closing paperwork for the home sale and insuring you have clear title to your property.

- You can shop for these fees but using the title company chosen by the seller in a purchase transaction or the lender in the case of a refinance often makes for the smoothest transaction.

- The largest of these fees, the settlement fees and lenders title insurance, vary based on the purchase price and loan amount respectively.

- These fees do not vary a great deal between service providers

- The lender’s title fee is offset by a credit when the policy is issued at the same time as the sellers policy

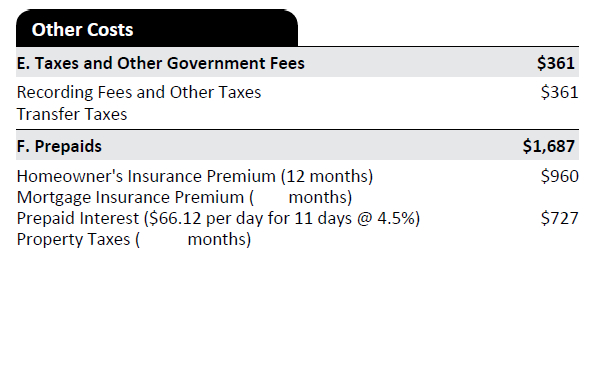

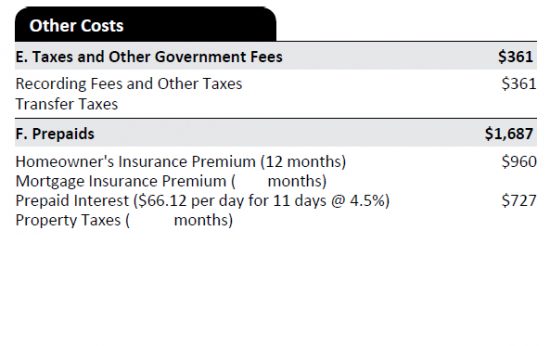

Government Fees and Prepaids

- Recording fees are charged by the county to record the transfer of title and record the lenders security interest in your property. They do not vary based on lender.

- There is not a transfer tax in Oregon with the exception of Washington County.

- If you opt to have an escrow account to pay your homeowners insurance premium and taxes, you will prepay for a year of homeowners insurance. The price you pay will vary based on the provider and policy you choose.

- You don’t make a payment in the first month after obtaining your loan. The interest accrued in the first month is paid at closing. This amount will vary based on the closing date you choose.

- The first month of property taxes will also be pro-rated. You may also have to pay property taxes to reimburse the seller for taxes they have paid.

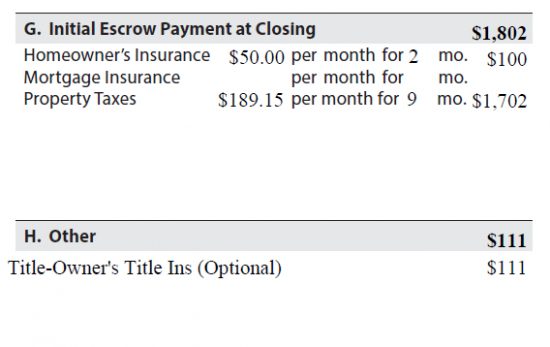

Initial Escrow and Other Fees

- If you have an escrow account, that account is funded with an initial contribution at closing as well as a monthly contribution that is part of your payment. The account will collect enough money to pay your homeowners insurance and taxes plus a two month cushion.

- The charge for homeowner’s insurance is based on the coverage you choose.

- The property taxes are based on the property you chose. The amount collected will vary based on the time of year when the sale closes.

- The initial escrow payment will not vary based on lender.

- The owners title insurance is paid by the seller.